You believe you are the world’s unluckiest investor. Somehow your taking a step into the markets will make them go down. Apart from giving yourself too much importance, this line of thinking makes you stay on the sidelines and prevents you from bringing home the wealth creation that equity in a growing economy makes possible.

Let’s take the story of the India’s unluckiest investor. She manages to invest Rs 1 lakh each year in the Sensex on the day the markets hit their 52-week high starting 1992. The Sensex is the 30-stock index whose value touched a lifetime high of 63,915 on 28 June 2023. A 52-week high is the highest value of the Sensex in a given year – I have taken calendar year values from the BSE database.

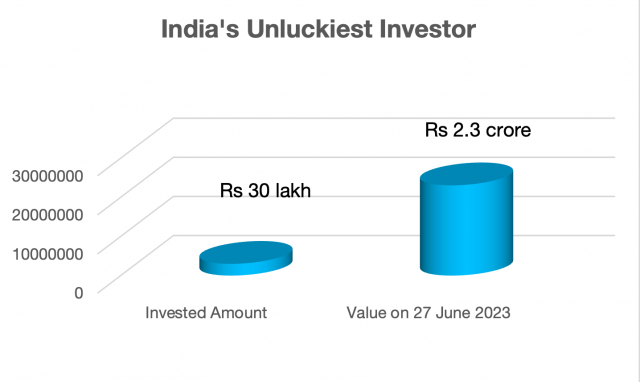

She does this year after year, somehow managing to be unlucky each year. But she does not sell, but continues to hold the index over time. As of yesterday, her total investment into the Indian stock market’s most famous broad-market index was Rs 30 lakh and the value of her investment was Rs 2.30 crore. That’s right. The worst possible outcome, if held tightly over time, has given an 11% average annual return.

This includes two years in which her money was reduced to half or less. In 1992, she invested at a high of Sensex value (ignoring decimals) of 4,547, and closed the year at 2,615. 2008 was far more brutal, a high of 21,207 was reduced to a low of 7,697, and a closing annual value of 9,647. Her money survived this bloodbath and kept its head over inflation and taxes.

How did the luckiest investor fare? I have data for a 52-week low starting 1996, so over this time period, the luckiest investor who bought the Sensex on the lowest point of the year, invested Rs 26 lakh and ended up with Rs 2.67 crore, an average annual growth of 15%. It is higher, but not hugely so than the unluckiest investors’ Rs 2.30 crore and growth rate.

The markets, long-term, go up in a growing economy. If you keep sitting in the sidelines waiting for a ‘low’ you will keep missing the flight. Do you know who has made money in the latest stock market high? It is not the big foreign suit of an institutional investor. It is not the HNI who is too smart for his own good. But the retail investors who have approached the market with a systematic investment plant and have remained invested. They have trumped the big money.

Start with an SIP into an index fund on the Sensex or the Nifty 50. Taste mutual funds through this route and as you gain confidence you can begin to diversify into managed funds on the mid- and small-cap side. Remember that you need a system and not a tip of 5 funds to invest in.

Monika Halan is the author of the best-selling book Let’s Talk Money

25 comments

Ashwin Chandrakant Matalia

June 29, 2023 at 8:23 am

Fantastic. Now I realise why I spent so much time in tracking and doing churning frequently and hardly managed to get 6 to 8 percent return per year. Patients is the key for success.

Neetesh Lodhi

June 29, 2023 at 2:15 pm

Great article mam

Satish Gupta

June 29, 2023 at 3:24 pm

She is my favourite author / guide on finance….Pls keep building us.

Satish Gupta

June 29, 2023 at 3:24 pm

She is my favourite author / guide on finance….Pls keep guiding us.

Eapen Abraham

June 29, 2023 at 4:11 pm

Superb article, well articulated and sharp insights.

A

June 29, 2023 at 4:53 pm

You must be among 0.25% of Indias population who could invest 1 lakh in sensex in 1992…

Useless pathetic misleading article…

A1

July 2, 2023 at 3:23 am

1 lakh is just an example. Focus more on 11% avg yearly returns

Gaurav

June 30, 2023 at 2:28 am

Pls include me in ur email group

Bakul Haria

June 30, 2023 at 3:16 am

An excellent illustration, easier read than followed.

Would like to hear about the luckiest one and more importantly the most consistent one (8333, every month)

Lalit

June 30, 2023 at 3:17 am

Excellent concept explanation.

Nishikant Hore

June 30, 2023 at 3:56 am

Invest Systematic thru mutual funds is the Mantra for successful investing…

Dhananjayan

June 30, 2023 at 5:42 am

Good article

Anupam

June 30, 2023 at 6:13 am

This should be followed by every retail investor. It is not required to put our brain to find when the market will go down. We should stay invested in good companies over a long period of time. And for Index investing there is very good book “Common Sense Investing” by John C Bogle.

Sanjay Arora

June 30, 2023 at 7:16 am

This article is hugely misleading.

“…….Rs 2.67 crore, an average annual growth of 15%. It is higher, but not hugely so than the unluckiest investors’ Rs 2.30 crore and growth rate.”

You are comparing 30 years return on the absolute basis of Unlucky with 26 years return of lucky. Compounding at 15% for 4 more years would have taken the amount of Lucky to Rs 4.60 Cr+, which is twice the final amount of Unlucky.

You should have, ideally, taken the data for 26 years for both.

Prabhakar Sridhar

June 30, 2023 at 9:13 am

Please suggest good Index funds , one each in Sensex and NSE please, I want to start Today !!!!!

SJ

June 30, 2023 at 11:46 am

This is an imaginary story. How do you know which day of the year, the market is at the highest?

However it does bring out the importance of SIP for passive investors.

It would be interesting to know what would be the returns if investors give a booster dose of some lump sum investment when markets are down, to the basic SIP. That’s not difficult to do and will surely give much better returns. That’s my strategy.

Pingback: The Infant Learner: 01 July 2023 – The Infant Learner

Ajay hinduja

June 30, 2023 at 5:28 pm

This pertains to index investing. But there are v bad funds which had shown abysmally low performance or to be precise flat performance over 10-15 years …thematic funds like Nippon Japan, Edelweiss china fund ….despite ceo telling put all money in China fund, axis esg,

These r truly speaking most unlucky investors

Ajay Sharma

July 1, 2023 at 6:43 am

It would be more interesting to see the performance of luckiest and unluckiest investor for the same period starting 1992 itself.

And I believe monthly investments during this long period akin to SIPs in mutual funds would give different and better results, where difference in returns for the luckiest and the unluckiest would be much lower.

Arun Gupta

July 1, 2023 at 1:28 pm

Nice depiction! It’s great to have a “Success Story” of even the so-called unluckiest investor 🙂

Can you share the data-points that you took – basically the 52-week highs of each year since the 1992?

If there was a graph showing precisely the 30 Purchase points, It would have been a perfectly substantiating demo.

Best

Anil sharma

July 1, 2023 at 3:35 pm

Mutual funds charges are high n at some places or m fund companies are higher.

Whereas investing direct ,charges are less.

Why the charges cannot be the same.

After all mf companies are also making money for themselves also

Because they hv huge corpus of customers and they hv this advantage of huge money but n charges are taken ftom customers .

Do they pooling.their profits also whencalculating nav or charges to customers

Sunil Rungta

July 2, 2023 at 6:30 am

Reassuring. We keep hearing this but panic and forget it as soon as markets dip. Good reassurance. Thanks

Sunil Rungta

July 2, 2023 at 6:35 am

Excellent reminder not to panic in dips. Long term holding always pays.

Vivek

July 3, 2023 at 8:08 am

Is it possible Monika to simulate in USD terms as USD/INR has lost 170%. Thus the market effect is of two things:

1. Increase in Index post Covid

2. Inflation in India resulting in INR depreciation

Mukesh Chandra Jha

July 9, 2023 at 11:51 am

Wonderful writen on Financial journey of a successful investor