Talk Theme

Borrowing to fund current bills is getting easier with technology and apps. But there is this worry about whether you are getting into a debt trap by borrowing too much. With this talk Monika Halan will help you understand how much is enough. She takes you through ‘good’ and ‘bad’ debts. And tells you which one to prepay the first and which ones to keep.

Talk Objective

How to use debt and not be used by it. You will learn:

- How much debt is good for you.

- What kind of debt is ‘good’.

- What is ‘bad’ debt and why.

- By what age should you be debt-free.

- How to manage peer pressure to stop using app-based debt.

- How to plan repayment and which debts to pay first.

- Learn whether you should save or replay debt first.

Learn to differentiate between good debt and bad debt

FROM EARLIERTalk Moments

Thank You Monika!

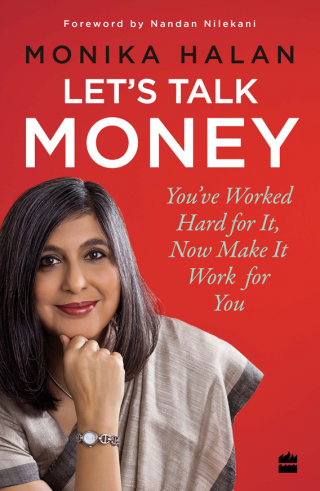

We at Sanskriti School are extremely grateful to Ms. Monika Halan, the author of Let’s Talk Money for gracing us with her presence for a workshop ‘Let’s Talk Money’. She interacted with the staff of Sanskriti School and guided them on investment and advised them on how to increase their savings in a world fraught with uncertainty. Investment and savings are matters of financial literacy that are accompanied by many myths and misconceptions and her session served to disprove them. Her interaction and elucidations enlightened the staff members about the various facets of saving and investment. She very systematically illuminated this matter by simplifying complex topics. Her interaction offered a lot of confidence to us. The session was followed by a very animated Q/A session which reflected the success of the workshop and the certainty that staff members gained on the matter.

Ms Richa AgnihotriPrincipal Sanskriti School

Thank you for the great insights you have provided us on both the days. Both the sessions have been a huge hit I must admit, and who can dare to forget the Bollywood tadka that you have presented in some of the slides in the first session. The Dhan chakra, the thumb rules to check for retirement, and the 6 money habits that lead to financial fitness have indeed been very helpful in understanding the dynamics.

And coming to today’s session as Arun had rightly foreseen, many of us were taken aback, rather alerted on the important aspects that some of us have missed doing or postponed. Your session today has clearly instilled some of these and am sure most of our employees are going to be working on similar aspects based on your recommendations.

Last but not the least have thoroughly enjoyed the association we have had with you, Monika. And we look forward to having more engaging conversations in future.

On behalf of the ServiceNow team, thank you once again for the “most engaging & informative session”.

Regards Sindhu Gopalakrishna Senior Business Operations Manager

Servicenow

Simple does it. Peppered with anecdotes, Monika Halan's book offers easy tips on personal finance

The WeekMagazine